Compliance

Inside UK's Financial Intelligence Unit: Safeguarding Economy

The UK’s Financial Intelligence Unit The UK Financial Intelligence Unit (UKFIU) is an essential organisation, offering vital intelligence about terrorist financing, money laundering and other activities that could impact businesses and other aspects of the finance landscape. Understand what the UKFIU does, how it helps combat economic crime in the UK and how you can use its resources to protect yourself from risks in...

How Adverse Media & Other Text-Based Data Helps Financial Services Organizations Stay on Top of Reputational Risk

What is your reputation worth? While reputation can be difficult to quantify, a study by the World Economic Forum suggests that more than 25% of market value can be attributed to an organization’s reputation. Particularly in the financial service industry, reputation and trust go hand in hand. In the years following the global economic crisis of 2008, trust in the financial services crashed too, and it wasn’t until 2016...

Global Trend Towards Mandatory Human Rights Due Diligence Accelerates as German Law Comes Into Force

Germany’s Supply Chain Due Diligence Act has been effective since 1 st January 2023. The new law requires large companies operating in Germany to carry out human rights and environmental due diligence on their business and its suppliers. Now, many countries are considering following Germany’s lead with similar regulations. In this blog, we look at how all companies can improve their compliance and due diligence processes...

Our Tips for meeting the Four Key Trends in Risk and Compliance in 2022

The landscape of risk and compliance is always changing. In the last few months alone, there have been developments in global regulations for anti-bribery and corruption and due diligence, and major enforcement actions against companies who have allegedly failed to comply. There have also been significant changes to national and supranational sanctions regimes, and louder calls for companies to demonstrate their ESG impact...

4 Ways to Streamline & Tailor Due Diligence Checks to Your Organization's Specific Concerns

Risk is weighing heavy on the minds of CEOs this year, according to the PWC annual global survey of business leaders. While PWC anticipates that "Digitization, an important lifeline for businesses during the pandemic, will probably be the engine for a return to health growth," the survey results also highlight that CEOs expect “somewhat” or “significantly increased” risk across a widening array of concerns. Not surprisingly...

Disruption has become the new normal–supply chain intelligence from data and technology is the solution

Recent years have been characterised by supply chain disruption–from Covid-19 to the Suez blockage to the invasion of Ukraine. Moreover, companies who fail to identify and manage illegal or unethical activity in their supply chain face increasing regulatory, reputational, financial and strategic risks. In this blog, we look at some of these risks, and show how smart use of data and technology can give companies critical...

The ESG Risk Series: Why ESG Risk Should be Top of Your Due Diligence Agenda

Regulators increasingly require corporates and financial services firms to incorporate Environmental, Social and Governance (ESG) risks into their due diligence and reputational risk management processes. ESG also brings opportunity: asset managers and investment banks have enjoyed significant returns by moving assets into sustainable funds, while companies who are transparent about their ESG commitments have been profitable...

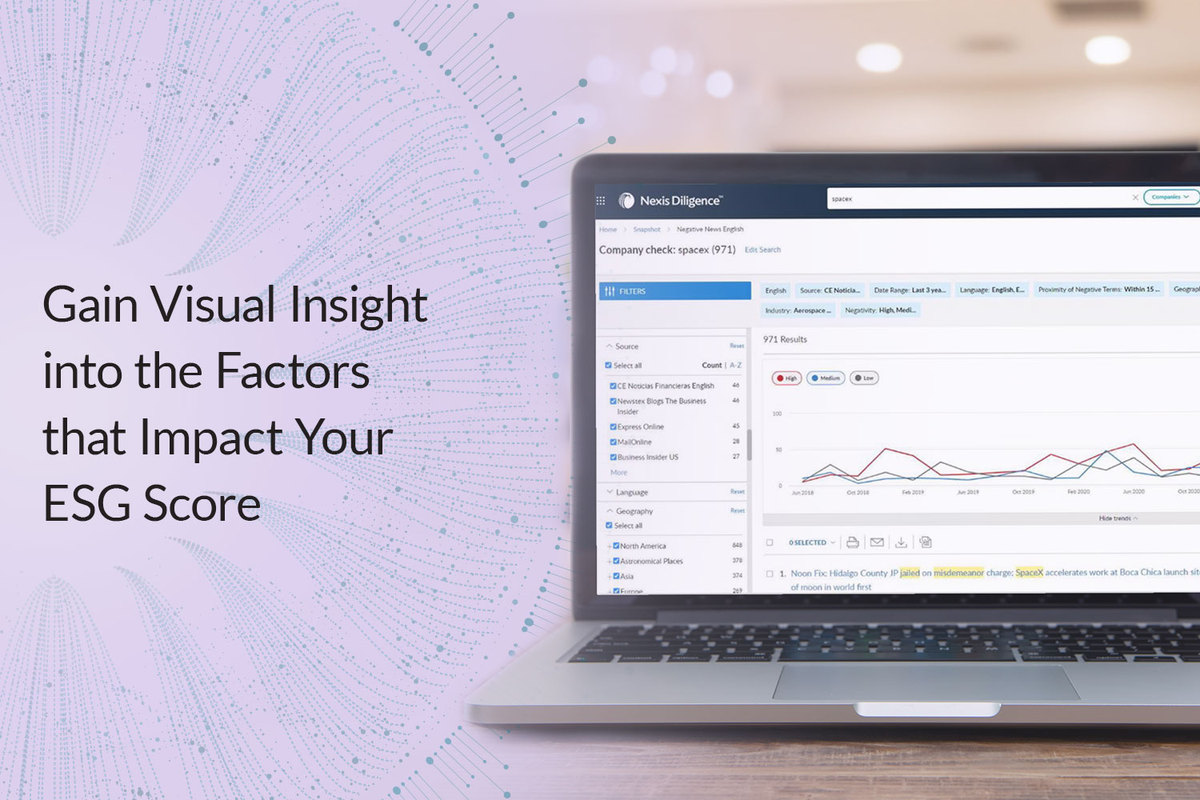

Identify the Risks to Your ESG Score—Quickly and Visually with Custom Risk Scorecards

Investors and consumers are increasingly looking to Environmental, Social and Governance (ESG) factors to determine which companies they support. While this illustrates a positive societal shift, with corporate entities and individuals alike calling on businesses to place people over profits, ESG scoring also simultaneously opens organizations up to a new risk landscape. Every vendor along your supply chain, every hiring...

6 Actions to Support Sustainable Development Goals (and the Advantages of Doing So)

The United Nations formally adopted what it calls its “2030 Agenda for Sustainable Development” in 2015. The UN invited corporations and companies of all sizes to join its member states in a collaborative effort based on, in its own words, “a shared blueprint for peace and prosperity for people and the planet, now and into the future.” The Sustainable Development Goals of the UN But what are the UN’s Sustainable Development...

Import Bans May Get More Muscle to Help End Forced Labor

Sometimes, the threat of financial consequences is enough to spur organizations to action. For example, in 2020, the threat of restricted access to the U.S. market spurred a company to make changes to address potential forced labor risk within its supply chain. The rubber glove manufacturer quickly undertook remediation to resolve the human rights issues associated with two subsidiaries. Mitigating forced labor risk...

Sanctions: What are they and why should you care?

Today’s headlines are full of news about current and evolving sanctions – but what are they and how could they affect your organization? What is a sanction? A sanction is a political or economic measure often implemented by governments and international bodies to influence the behavior of a regime, group, or individual. These can include actions like travel bans, asset freezes, import/export restrictions, and more...

Timely Data Helps Refresh Due Diligence and Identify Risks as Sanctions Escalate

The sanctions landscape has undergone a swift change since February 21 st . as world leaders acted with unprecedented speed and resolve to the invasion of Ukraine. As the Center for Strategic & International Studies (CSIS) noted recently, the invasion “… galvanized a united response from U.S. partners around the world. The European Union, United Kingdom, Canada, Australia, Japan, South Korea, and Taiwan have all announced...

Last Year's Sanction Enforcements Prove Supply Chain Visibility Crucial to Compliance

A decade ago, sanctions compliance appeared focused on banks and other regulated financial services. In recent years, however, that spotlight has become a floodlight across many industries. Why? Globalization and digitalization are two factors that have enabled incredible growth, but in expanding geographic reach, businesses’ reliance on third parties has grown too. Organizations undertake mergers or acquisitions...

Three Supply Chain Trends to Watch in 2022

The COVID-19 pandemic brought a lot of things to light – one of which was the fragility and complexity of our global supply chains. As our business change and evolve to fit the new normal, it’s time to look ahead at what you can expect for your supply chain in 2022. Sustainability Creating sustainable business practices is becoming more and more important to consumers around the world. In fact, 66% of millennials...

What Dots Can You Connect with LexisNexis?

How can you feel confident in your operations without full visibility into your supply chain? More than 90% of supply chain executives say this is important , but less than a third of them have achieved true visibility. With the right technology, you can connect the dots to get a full picture of your supply chain. Creating this environment of efficiency and resiliency helps you prevent minor and major issues in the...

How to Better Manage Risk with Proper Due Diligence

How to Better Manage Risk with Proper Due Diligence There will always be some kind of risk to your business on the horizon. That much is certain. But what about the risk that’s right under your nose that you can’t even see? Not to sound so alarmist, but the reality of our digitally and economically connected world is that all kinds of strategic, regulatory, financial, and reputational risk can hide in plain sight. ...

How to Tackle the Recent Rise of Supply Chain Instability

Supply stain stability is, well, in short supply. From an economic perspective, COVID-19 might serve as a temporary setback (though only time will tell), but the pandemic has exposed just how easily the supply chain can be disrupted in the wake of certain events. Today, it was COVID-19. Tomorrow, it could just as easily be political turmoil abroad or rolling blackouts in key manufacturing sectors. And while COVID-19...

Top 3 Benefits of Combining Your Due Diligence and Risk Monitoring

To fend off financial and reputational risk, you must stay vigilant on multiple fronts – be it in the HR office when deciding whom to hire or at any point in your supply chain when choosing your vendors. In other words, the risks to your company have not only multiplied, but they’ve also diversified and now come from every possible angle. And no single risk management method can keep these threats at bay on its own...