Latest Blogs

How Risk Managers Benefit from Using Quality Data

When it comes to the data used for predictive modeling and risk management, you can’t afford to leave anything to chance. Risk managers today have an ever-increasing number of AI applications and risk...

The Changing Roles of Risk Managers in the Age of Data, Technology...

Risk management is paramount to the upkeep and success of a business. To make sure you are staying compliant, you should continuously check all operations for potential pitfalls, like illegal trades or...

The Cost of Low-Quality Data for Decision Intelligence

In the quest to achieve unrivaled business growth, organizations show increasing interest in Decision Intelligence (DI) . Whether you use DI to augment, recommend, or automate decisions, the effectiveness...

Nexis Diligence+™︎: Taking Your Due Diligence to a Higher Le...

When it comes to business, it’s important to have high standards—especially when evaluating risk and protecting your reputation. To do so requires a comprehensive due diligence process that’s powered by...

9 Steps For Better Third-Party Anti-Bribery and Corruption Due...

Companies operating in today’s global business environment must navigate ever-strengthening anti-bribery and corruption regulations. Some of the most significant recent enforcement actions against companies...

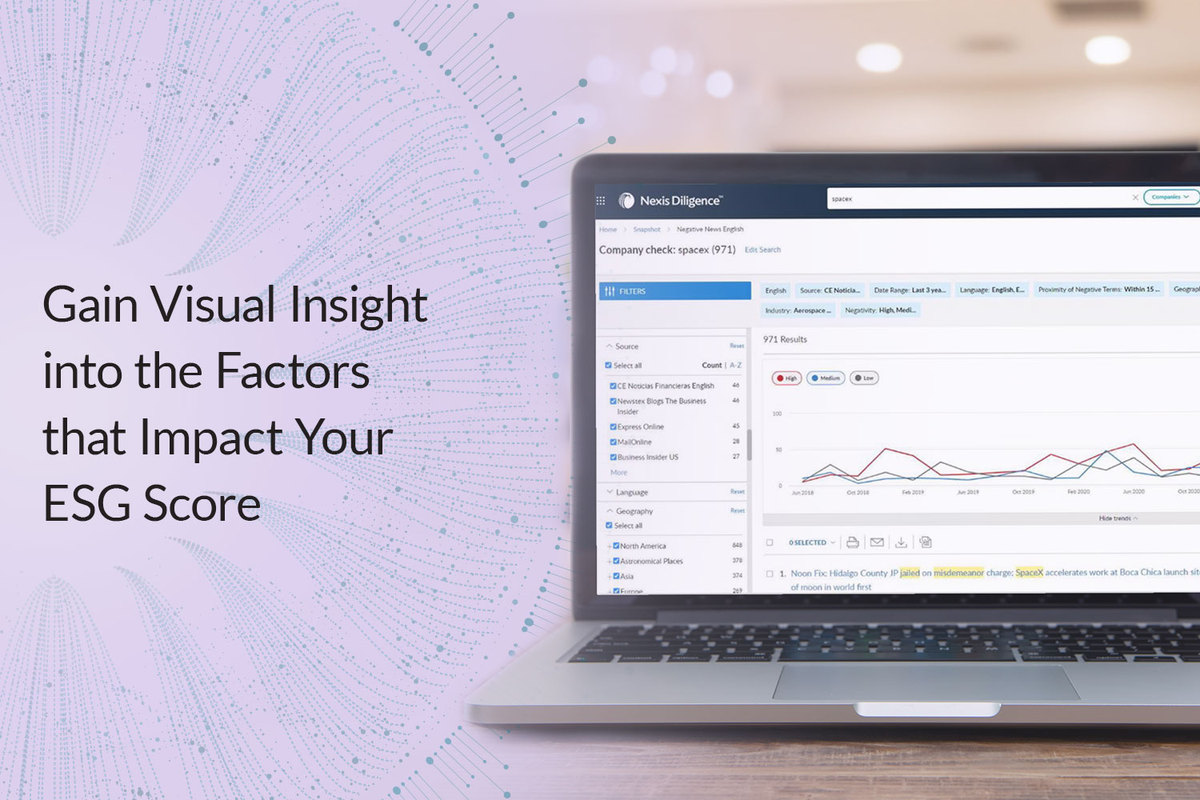

Investors and consumers are increasingly looking to Environmental, Social and Governance (ESG) factors to determine which companies they support. While this illustrates a positive societal shift, with corporate entities and individuals alike calling on businesses to place people over profits, ESG scoring also simultaneously opens organizations up to a new risk landscape.

Every vendor along your supply chain, every hiring decision you make, and every other entity you do business with holds the potential to either positively or negatively impact your ESG score. Additionally, governments around the world are passing new regulations—seemingly around the clock—based on ESG factors. How well you and your business partners adhere to these regulations can also impact your ESG score.

How you can better understand ESG risk factors

Your organization needs a way to conduct a due diligence investigation that considers critical ESG factors. You also need a way to monitor for ESG risks that stem from your potential and existing business relationships continuously and reliably.

Nexis® Entity Insight helps you identify and prioritize the specific risks to your organization’s ESG score. It not only monitors a wealth of unmatched data (including 24/7 news feeds, financial information, corporate hierarchy data, and sanction and watchlist information), it also visualizes this data in a way that helps you immediately understand the most urgent risks you need to act against.

Better understand risks to your company’s ESG score with a custom risk scorecard

The idea of expanding current risk monitoring resources—which are likely already stretched thin—to monitor for and evaluate risks to your ESG can feel daunting. But with a custom risk scorecard in Nexis Entity Insight, you can better manage the sheer volume of data and quickly assess all financial and reputation risks your company faces.

That’s because Nexis Entity Insight ingests vast quantities of data on the third parties and entities that interact with your organization. Then it identifies and categories each risk based on your organization’s unique considerations—be it ESG factors or anything else.

How custom risk scorecards work to deliver insight into ESG risk

We work with you to develop a risk scorecard aligned with your precise needs, and this includes incorporating the factors that determine the ESG scores of your third-party relationships. Once we’ve determined which ESG factors are most critical to your organization, we integrate the third-party data feeds from your existing solutions and merge it with our content to capture a customized, holistic view of potential ESG risk. As a result, you:

- Gain a more complete, highly visualized view of risk factors that affect your ESG score

- Achieve improved overall risk awareness to protect your organization against regulatory, reputational, financial and strategic risk

- Capture a broad view of low, medium and high risk specific to your organization

- Can take proactive measures that protect your organization’s ESG score

To learn more about how a custom risk scorecard in Nexis Entity Insight can help you monitor for and respond to ESG risks, go here